How Can We Help?

How to Return Goods to Supplier

Purchase Entries can be made by following

- Procurement -> Goods Return Ad-hoc (Without any reference)

- Navigate to Goods Return and create a new Document

- Procurement – Transaction – Goods Return

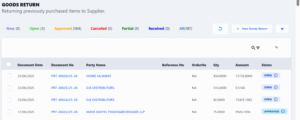

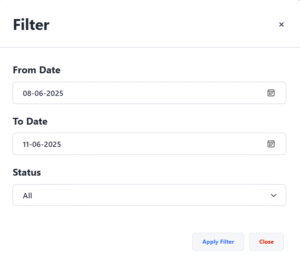

- A list will appear when you click on Goods Return which shows by default recently made documents, filter option is available for old records

- List

- Filter

- Print / View or Edit

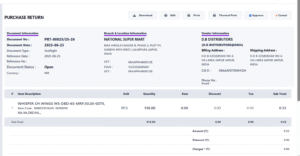

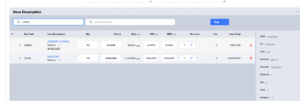

To print, view or edit a document click on the Document No- A new interface appears which is view of Document with all details, there is a toolbar on top with action buttons such as EDIT, PRINT & APPROVE

- A new interface appears which is view of Document with all details, there is a toolbar on top with action buttons such as EDIT, PRINT & APPROVE

- Please note a document is editable until it is not approved, an approved document is not editable

- List

- Create a Return

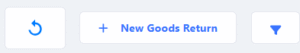

- Click on New Goods Return

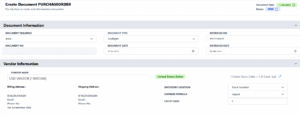

- Enter Reference Date and Reference No which can be Bill / Reference Details of Supplier Document etc.

- Select Vendor

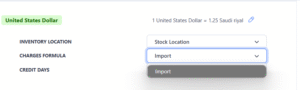

- If it is a foreign currency (overseas) vendor, please check and edit Exchange Rate, to edit exchange rate use Pencil icon next to Ex Rate.

- Be cautious about Formula

At time of implementation Animo RETAIL configure multiple formulas as per requirement as some may have VAT/GST and some may not have it, some Tax Calculations may consider Additional Charges such as discount and freight too and some may not, so choose it wisely.

- Item Information

- Scan a barcode

- Item Help or Search by Article, incase barcode is not available.

- There are some other options like

- Excel Upload –

- Excel Sheet with columns

Barcode , Quantity , CostRate, SalePrice - Excel Sheet with columns

Barcode, Quantity

- Excel Sheet with columns

- Excel Upload –

- Scanned Item will appear in Grid

- Change the Quantity

- Change the Rate (if overseas, enter foreign currency rate and system calculates and put rate as (Rate in Vendor Currency) * Ex Rate

- If required change RSP and Listed Price (MRP)

- Discount on Item Level, recommended to use only if for every item there is a different discount to be applied

- Tax Calculation will be done automatically by system

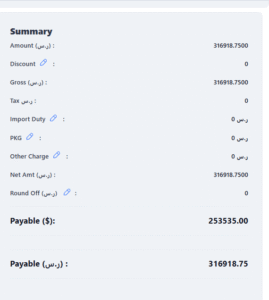

- Once all items are scanned scroll down to summary block and enter additional charges as per requirement

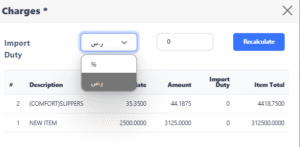

- any of these charges can be entered as amount or % To edit the charge click on Pencil icon

- Do note if Discount is edited here it will impact on all items and override discount entered on Item Level.

- any of these charges can be entered as amount or % To edit the charge click on Pencil icon

- Click on New Goods Return

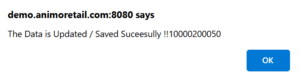

- Verify if all information is filled correctly save it

- Once you click on OK it will redirect to Goods Return list

- Procurement – Transaction – Goods Return

Need more help?

If you have questions or need further assistance, feel free to create a ticket https://animoretail.raiseaticket.com/ or browse our other help articles.